Get the free anz discharge form

Show details

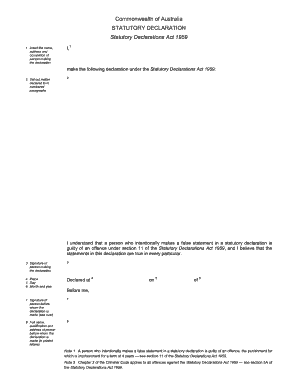

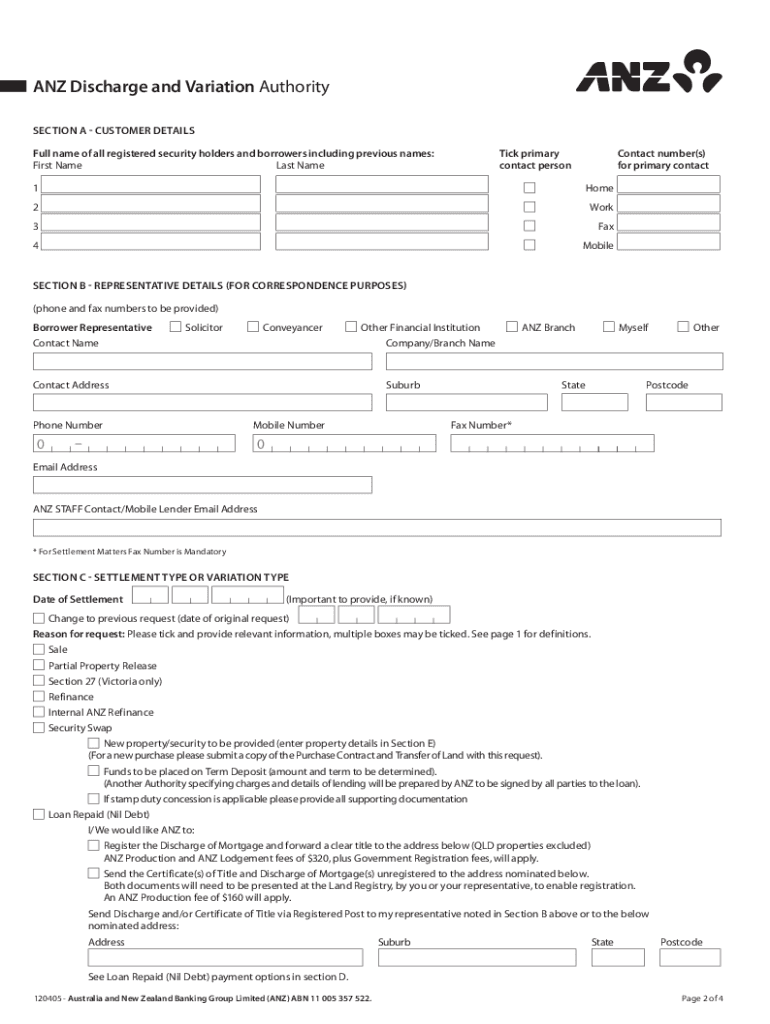

ANZ Discharge and Variation Authority To assist us in processing your request in a timely manner please complete appropriate sections in full as missing details may result in delays. This request must be signed by all parties to your loan including Guarantors not only property owner s. Any fields that are not applicable should be marked N/A. For business loans please contact your Relationship/Business Manager to arrange for release of property. For all enquiries please call 1800 603 361 ANZ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anz discharge authority form

Edit your anz discharge form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anz discharge authority form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing anz mortgage discharge form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit discharge authority form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out anz discharge authority:

01

Begin by downloading the anz discharge authority form from the ANZ bank website.

02

Fill in your personal information, including your full name, address, and contact details.

03

Provide your ANZ account number and any relevant account information.

04

Specify the reason for wanting to discharge the authority, such as closing the account or transferring funds to another bank.

05

If you are transferring funds, provide the details of the receiving bank, including the bank name, branch name, and account number.

06

Sign and date the discharge authority form.

07

Submit the completed form to your nearest ANZ branch or send it via mail as instructed on the form.

Who needs anz discharge authority:

01

Customers who wish to close their ANZ account and withdraw their funds.

02

Customers who want to transfer their funds from ANZ to another bank.

03

Individuals who have joint accounts and want to remove one account holder's authority.

Fill

anz bank discharge authority

: Try Risk Free

What is anz discharge authority?

A discharge/refinance authority is used to release the security (e.g. property or cash security) you've provided for a home loan. ... Selling / sold a property \u2013 you're selling a property.

People Also Ask about anz discharge and variation authority

How long does ANZ discharge processing take?

ANZ will attempt to process your request within 10 business days from the date received, provided that all of the correct information and required supporting documents (if any) are submitted.

What is a discharge authority form?

A discharge authority form is used to release the security (e.g. property or cash security) you've provided for a home loan.

What is the current variable interest rate at ANZ?

ANZ Standard Variable home loan Your Loan to Value Ratio Superscript: 3 TooltipInterest rate disclaimer, Superscript: 7Comparison rate Superscript: 8 TooltipLVR 80% or less7.29% p.a. Superscript: 56.98% p.a.LVR more than 80%7.49% p.a. Superscript: 57.19% p.a.Index rate Superscript: 108.69% p.a.8.40% p.a.

How do I get discharge authority from ANZ?

To make a loan closure request: Go to the Home page, which is the first page you see when you log on to ANZ Internet Banking. Select your loan account. Select the "Loan closure request" link.

How much is the discharge fee for ANZ variable home loan?

CBA charges a discharge fee of $350 for their Standard Variable and Base Home Loans but do not charge a fee for their No Fee Home Loan. ANZ charge $160 in settlement fees (in addition to other fees to access government records and to lodge paperwork).

How do I discharge my ANZ mortgage?

You can request to close your ANZ loan online at any time. This can be done via an Online enquiry, which an ANZ Customer Service Consultant will respond to within 24-48 hours. The amount required to pay out your loan may change ing to the date on which it is paid.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my anz discharge authority form pdf in Gmail?

anz discharge of mortgage and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get anz discharge and variation authority form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the anz home loan discharge form. Open it immediately and start altering it with sophisticated capabilities.

How do I edit anz discharge of mortgage form online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your anz dava form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is anz discharge authority?

ANZ Discharge Authority is a legal document that allows individuals to authorize ANZ to release their mortgage or loan upon settlement of the loan. It is often used when the loan is paid off or refinanced.

Who is required to file anz discharge authority?

The borrower or the individual responsible for the mortgage or loan is required to file the ANZ Discharge Authority.

How to fill out anz discharge authority?

Fill out the ANZ Discharge Authority by providing necessary details such as the borrower's information, loan details, and the reason for discharge. It should be signed by all parties involved in the loan.

What is the purpose of anz discharge authority?

The purpose of the ANZ Discharge Authority is to provide formal consent for ANZ to discharge a mortgage or loan, allowing the release of the property or assets from the mortgage obligation.

What information must be reported on anz discharge authority?

The information that must be reported on the ANZ Discharge Authority includes borrower details, loan account number, property details, and any specific instructions or reasons for discharge.

Fill out your anz discharge form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anz Loan Discharge Form is not the form you're looking for?Search for another form here.

Keywords relevant to anz discharge form pdf

Related to anz discharge authority form online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.